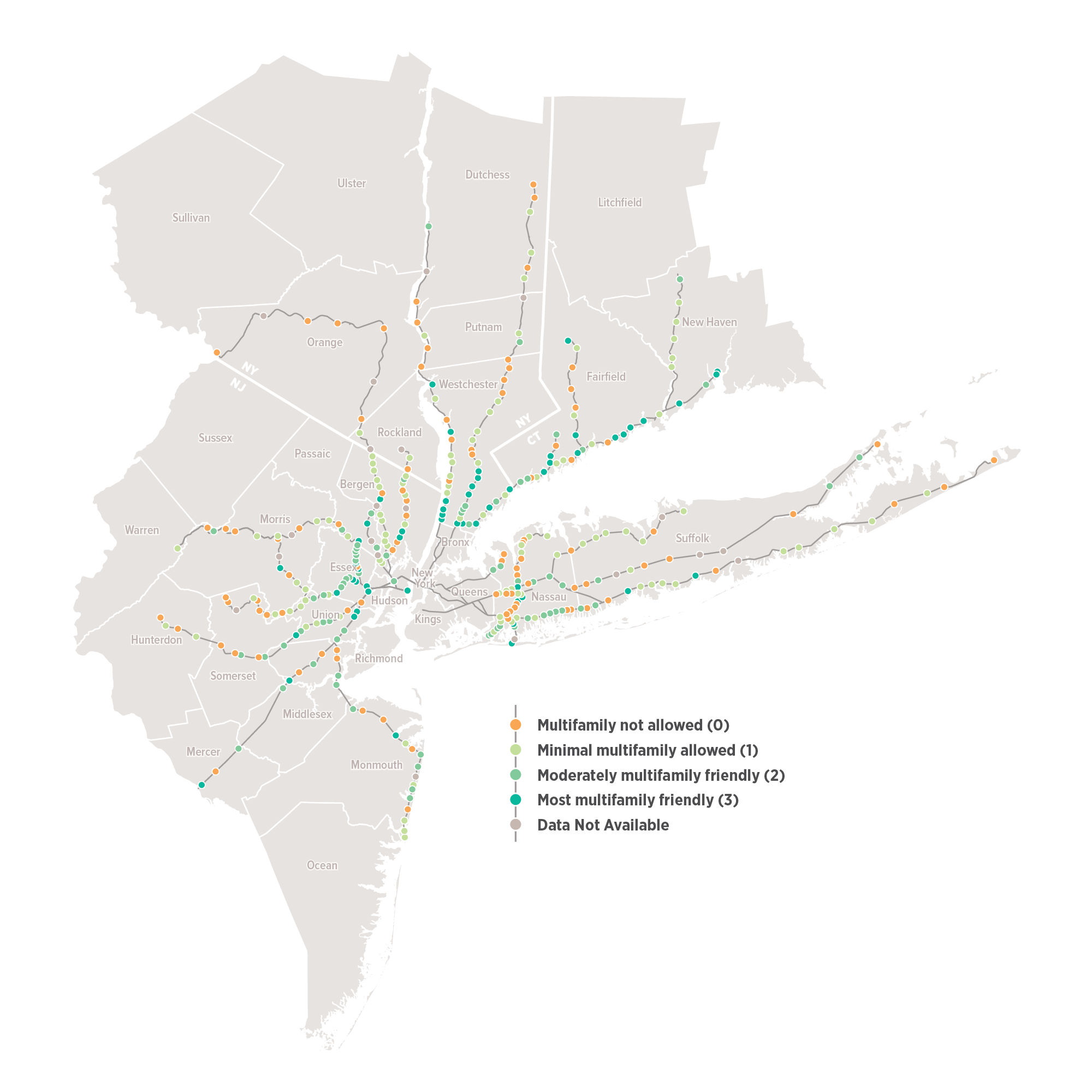

Property tax policy and zoning and financing restrictions often make it difficult to build more homes where it makes sense—for instance, in walkable or potentially walkable neighborhoods near mass transit. Instead, locations with easy transit connections to job centers are used for part-time parking. Places that could become vibrant mixed-use districts that provide jobs and urban amenities are limited to residential uses, with any kind of shopping or other excursions requiring car trips. And in our region’s core, artificial restrictions limit both housing and commercial space in places where they are needed and the market could support them.

Lift restrictions to encourage new homes and mixed-use development with good access to jobs

Paying for it

Implementing these recommendations would produce significantly more revenue than costs for the cities, towns, and villages that enact them. By allowing and encouraging development in places where the market can support it, development costs would mainly be incurred by the private sector. This would lead to increased public revenue through property taxes, and to a lesser extent, local sales taxes through added economic activity and commercial space. Job growth through more construction and commercial activity would also mean increased wages, which adds to revenue and economic activity.

Allowing for significantly more development throughout the region, especially small- and medium-construction projects should also encourage more business development among contractors and subcontractors, thereby increasing competition and ultimately lowering construction costs. The vacant land tax would also lower land costs.